Right decisions at the right time will make the companies successful in their businesses. With the digital transformation almost all the companies are becoming technology companies today. Providing modern, frictionless customer experiences to their customers in a secured way does keep the customers with the business.

The increase of devices which the customers use to connect with the business, the rapidly evolving customer requirements and the customers expectations on security and privacy are the key factors for the companies who focus on providing modern frictionless customer experiences to their customers.

This is why the Customer Identity and Access Management (CIAM) is given a key role in modern businesses.

Why is Customer Identity and Access Management (CIAM) a must-have for your business?

CIAM is still a relatively young technology but it is increasingly becoming a must-have for customer-centric businesses. These are the reasons:

- It allows bringing frictionless experiences to the market quickly while balancing the need for future-proofed identity, security and scalability.

- CIAM is foundational technology that meets increasingly complex customer requirements and enables companies to deliver secure, seamless digital experiences.

- Focusing specifically on managing the identities of customers who need access to corporate websites, web portals or webshops is a key factor in CIAM.

- Instead of managing user accounts in every instance of a software application of a company, the identity is managed in a CIAM component which makes it possible to reuse the identity in different software applications.

Why is the CIAM necessary in the banking and the finance sector?

Security is a critical factor in exposing services over the internet in the banking and the finance sector. Therefore making sure relevant security features are added from the customer registration journey to all the other activities, is a responsibility of banks and finance sector institutes. Meanwhile they also need to make sure their customers can carry out their activities with the latest trends of CIAM, like registering with the business using multiple devices. Because serving customers with the latest trends makes the customers happy because of the frictionless experiences they get.

When we talk about CIAM below are some of the key things which the customers would appreciate from banks and finance institutes:

Passwordless access

As a customer of a bank you would like to get frictionless experience when using the digital services of your bank. But on the other hand you worry about the security as well, because you have kept your valuables there.

So when we think about frictionless experience in login, customers would love to use passwordless access but they want to make sure it’s well secured as well. Passwordless is an authentication mechanism which uses some other easier method to authenticate instead of a password. Remembering a secured password is not a frictionless experience for a user.

Biometrics as a second factor of authentication

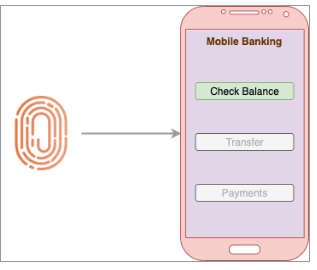

Biometrics can be used for this purpose. Fingerprints are the most commonly used identifier in biometrics, but there are other identifiers like DNA, irises, voice patterns, palmprints, and facial patterns. With the advancement of technology, biometrics readers have come to mobile devices now. Fingerprint readers and cameras are embedded into the mobile devices. Taking the advantage of this the authentication can be done using biometric identifiers like fingerprints or face. With this passwordless access can be achieved to make sure that the customers get frictionless experience while using their services.

But when we consider the security factor in the banking and financial sector it’s better if we can limit the access to some operations for passwordless access. Considering this, generally in the banking and financial sector only a selected set of operations are provided with passwordless access.

As an example a bank user can log in to the online banking facility but the user only can check the balance and transaction status and history. Operations like payments, fund transferring etc, are not allowed with passwordless access.

Adaptive Multi-Factor Authentication

Another important thing in CIAM is multifactor authentication. The factors in two factor or multifactor authentication is mainly divided into three parts, those are,

- Possession – Something you have.

- Knowledge – Something you know.

- Being – Something you are.

When it says two-factor authentication in a regulation, two factors should be chosen from above three, it should not be in the same category. That would make the access bit harder. As an example just because you have something you can’t get the access to, you also need to know something as well.

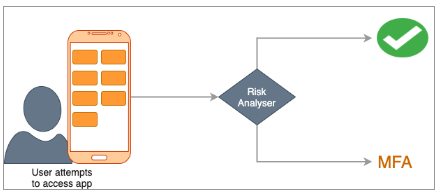

Adaptive authentication is an advancement of multifactor authentication. Where the multiple factors will only be prompted when there’s any unusual activity happening. As an example, when a user login to the system from a different country, the system detects that the user is not login from the usual location, therefore this may not be the actual user, so the system asks for another factor which already has been configured when setting up the account.

Likewise the customers would get a frictionless experience in almost all the times, except any anomaly is detected. So in the banking and finance industry this adaptive authentication is very helpful to give frictionless experience to the customers by not enforcing additional steps all the time in login.

Unified logon (SSO)

SSO is a very famous feature which reduces the multiple login when a customer visits a set of digital applications of the same group. If the SSO feature is not used, the customer has to login many times, when using more than one application in the same group, and trying to remember the credentials while using these applications is not an easy task for customers.

Therefore sharing a single logged-in session among other pre-agreed applications eliminates duplicate re-logins and the customer only needs to login once, and it will allow the customer to continue his journey to other related applications as well. Therefore this is a must have feature in CIAM as it reduces the friction in customers’ experiences.

Consent Management

Consent management refers to the practice of prompting, collecting and managing user approval for the collection and sharing their personal information. Therefore this is a very important fact for the customers. Because before getting a customer’s consent, the system should clearly indicate what the customer is going to approve.

In General Data Protection Regulation (GDPR) which is the EU law on data protection and privacy in the European Union and the European Economic Area, it indicates that.

- A consent should be freely given and should offer a genuine choice.

- A consent should be specific about its purpose.

- The processing organization should ensure that persons giving consent understand exactly what is being shared and for what purpose.

- A consent should be given by a statement or by a clear affirmative action such as through an electronic form submission.

All above CIAM features are, must have features to make sure the customers get frictionless user experience in the banking and finance sector while ensuring the security of the services.

How does Chakray power better CIAM?

Chakray is a provider of full digital transformation solutions, which includes Identity & Access Management, API Management, Integrations and Analytics. When providing the CIAM solutions what we’ve experienced is that the requirements are different from client to client. And most of them have internal limitations as they are in a journey of digital transformation, due to this reason they expect workarounds or customizations, while making sure the solution is secured enough. Because security is a key factor in the banking and finance sector.