In this article we are going to talk about what Intelligent Automation is, its uses within financial services as well as the benefits of using it.

What is Intelligent Automation?

Intelligent Automation (IA), is the use of three automation technologies:

- Artificial Intelligence (AI)

- Business Process Management (BPM)

- Robotic Process Automation (RPA)

Intelligent Automation is used in order to streamline across organizations and simplify processes, free up resources and improve operational efficiencies.

Intelligent Automation initiatives are applicable to different types of industries and to companies of various sizes, companies in the financial services are one of the ones that perceive the greatest benefits as a result of their implementation.

-This article may be of your interest: Amplifying the Value of Automation with IPaaS–

Uses of Intelligent Automation within financial services

How does Intelligent Automation help in financial services? The uses of Intelligent Automation in financial services are multiple, but we will tell you some of the most relevant ones:

- Identifying money laundering. Fraud detection is one of the main uses of Intelligent Automation among financial companies, as it not only speeds up processes, but also the efficiency in detecting money laundering cases. It collects customer and counterparty data information from various sources and alerts on potential AML transactions.

- Real-time transaction analysis and risk monitoring. Intelligent Automation in financial services allows for faster data analysis, accurate forecasting and the identification of potential problems before they arise.

- Automating processes and Scanning and processing documents. Intelligent automation enables the automation of a large number of manual tasks, such as the creation of customer accounts, which consume many hours of work. Its application in financial reporting enables data verification and improved reporting by extracting key data and information and reviewing legal documents. With Intelligent Automation, financial services companies can transform manual and data-intensive operations while still meeting the demands of ever-changing regulatory requirements.

- Finding best-fit financial products for customers and optimizing sales and customer services. In this area we can mention several use cases, for example the use of chatbots in financial services, which reduces waiting time and offers a self-help solution to customers, improving the customer experience. Over 90% of financial service companies have obtained positive ROI from Intelligent Automation. It also help customer service agents perform their roles better by automating application logins or commissioning tasks so that customers are served better and faster.

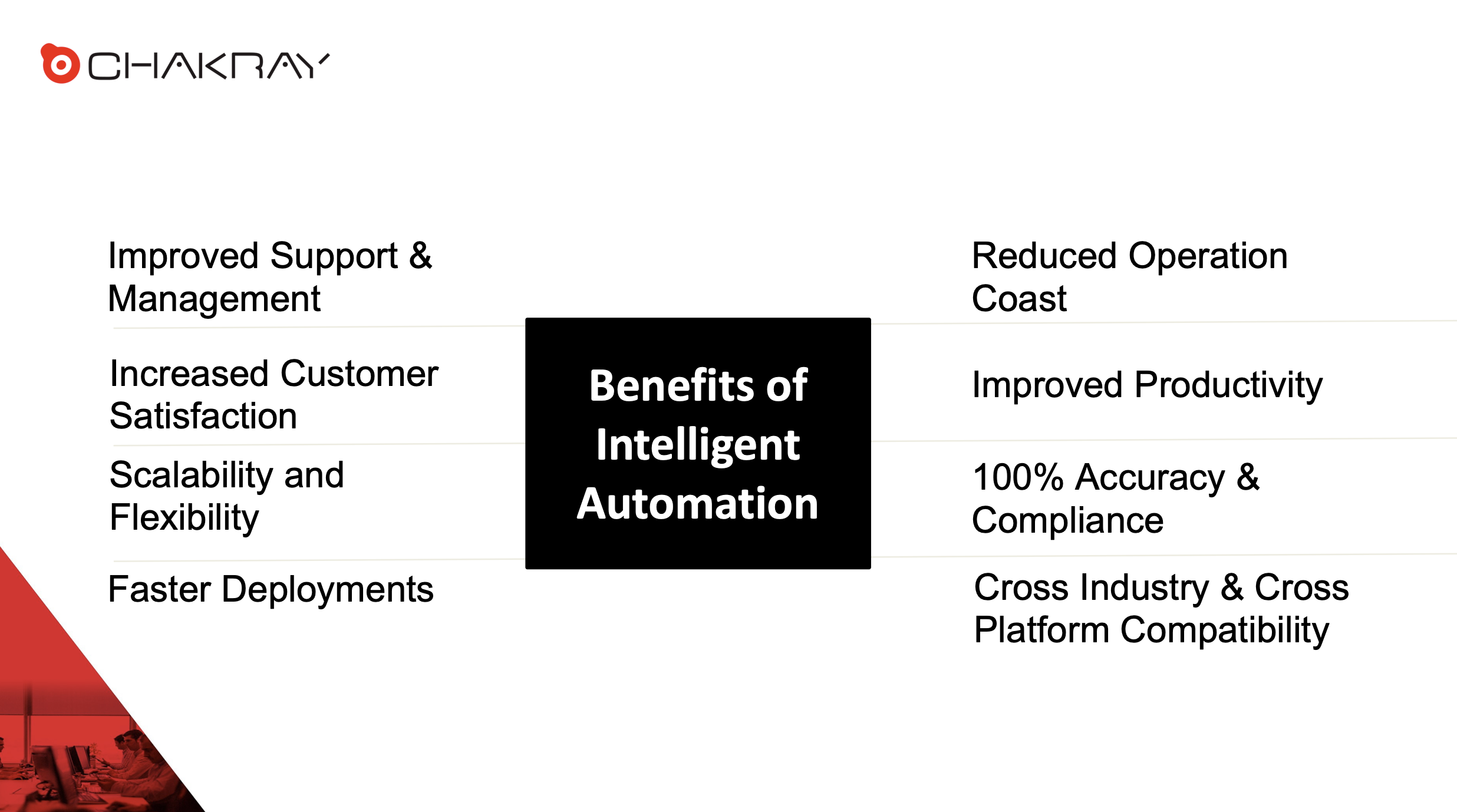

Benefits of Intelligent Automation in Financial Services

Now let’s focus on the benefits of using Intelligent Automation in the Financial services:

- Lower costs/Decreasing costs: Automate manual and data-intensive processes to increase productivity and decrease manual labor expenses.

- Consolidate compliance: Directly access customer data to improve customer knowledge (KYC) and anti-money laundering (AML) process analysis, automate monitoring of ongoing transactions, and track regulatory changes.

- Optimize operations and reduce risks: Simplify and automate manual processes, eliminate processing errors, and reduce operational risks.

- Accelerate return on investment: Deploy robotic process automation in three months and get an immediate return on investment.

- Improve customer service: Gain real-time access to customer information, accelerate response to their requests, and identify other product and service needs.

- Increase resource capacity: Deploy digital workers to empower employees and increase capacity for peak processing volume situations.

Figure 1. Benefits of IA in financial services.

Challenges of Intelligent Automation in financial services

Although it has wide applications, IA also faces challenges in the financial services that can prevent the growth of the business. Some of the challenges are:

- Lack of IT support. Requires IT teams skilled in Cloud operations.

- Lack of employee support. Implementing any new system or process requires human support.

- Unclear vision. Clear strategy is essential to have a global vision of its full benefits.

- Fragmented processes. While processes at companies are normally fragmented by departments, Intelligent automation involves automating several processes across departments and teams.

The impact of those challenges can be reduced if using Workato, which we will talk about in the next point.

Workato & Intelligent Automation

Workato enables companies to implement enterprise-wide automation, without worrying about uncertain costs for different automation projects.

The low-code automation platform is the solution as they don’t require technical expertise on the part of users and thereby enable wide-spread adoption.

It can automate the most critical business process which is the revenue process: pricing, contracts, billing etc. It can also record payment status and its history, keeping the vendor data in sync in order to automate expenses, payroll, payments and RMA. The documents are automatically uploaded and organized in order to meet audit control points. It also offers quote to cash, building automation, transparency, speed and control that enables growth and improved analytics. It can automate any procurement process and so can help the streamline procurement workflows without writing a line of code.

Finally, it continuously monitor and collect all spend data in one board, giving the team the power to make decisions with real time reporting.

Conclusion

The implementation of Intelligent Automation technologies allows companies to drive innovation within their work structures to reinvent critical areas of the business.

In this way, Intelligent Automation gives them the possibility to create new processes to achieve the margin of competitiveness and profitability they need. Employees are more willing to use their full potential, adding value to the organization and the customer experience.

As we can see, although IA changes the labour paradigm, its implementation does not imply at all the destruction of human labour. On the opposite, it is a tool that, when well applied, frees employees from monotonous tasks, boosting their talent.

If you think your organization needs help on that journey and want to know more about it, do not hesitate to contact us for more information!